We all want financial freedom. Whether this means early retirement or starting down a whole new career path, financial freedom is necessary for following our dreams.

Wise investment decisions are one of the best ways you can achieve this, and real estate makes for a great investment opportunity.

However, not all real estate investments are a guaranteed success. You’ll need to apply strategies like the following to ensure that your investment nets you a healthy, liberating return.

1. Build your ideal budget.

Your first step in making any real estate investment decision should be to build a thorough and accurate estimation of your costs. You don’t want any big surprises in the process as you make offers and acquire financing. Instead, start with a comprehensive budget.

Sometimes investors forget all that this will entail. Consider all the following factors in building your own long-term budget:

Closing costs

Annual maintenance costs

Insurance

Utilities

Taxes

From here, you’ll have a better understanding of the capital you need and where this puts you in terms of what you can afford.

2. Find the right location.

Your budget will inform where you want to invest. The location is essential when determining the financial future of the investment, how much the property and its rent values might appreciate, and what you can expect from your ROI.

You should choose a location that will always be in higher demand, like those with waterfront views or are in a growing city with ample employment opportunities and room for growth. Then gauge market data to determine what size properties perform the best when it comes to rental income.

3. Create a comprehensive investment schedule.

One aspect of calculating both your budget and your overall investment goals when getting started is to lay out a timeframe for how long you want to own and/or manage the property. Real estate can be an involved investment type, so setting these schedules and expectations now is a great way to set yourself up for future freedom.

Build a timeframe now based on what kind of return you want for your property given its potential. Then, you can have a better idea of when you might want to sell or move on.

4. Set your goals.

With a schedule and budget in hand, it’s time to work out exactly what your goals are for the investment.

Do you want it to passively make your mortgage payment while you build retirement savings? Do you want it to appreciate in value so you can sell it as a retirement nest egg?

Answering questions like these now about what the property should mean to you—not just fiscally but emotionally—can help you on the path to success.

5. Find the right financing.

Then, it’s time to find the ideal financing for your investment property. This will vary depending on interest rates and market conditions at the time of your decision, but you need to find the right rates so that you can easily pay your mortgage with rental income and have some leftover.

A good rule of thumb is to expect your interest rates to be 0.50% - 0.75% higher than that on your primary mortgage. So if you got a 2.8% APR on your residence with a 30-year-fixed mortgage, you should look for a financing deal in the 3.3% - 3.55% range.

Calculate your payments along with your estimated rent income to make the rate deal for you.

6. Don’t spend your whole budget on purchasing the property.

But in balancing your financing options with your overall budget, you don’t want to limit yourself to the property alone. You’ll need cash on hand to take care of all the other overhead costs of managing a successful real estate investment.

This means setting yourself aside a budget for remodeling, maintenance, legal fees, and more. For example, 1% of a property’s value can be expected as any annual estimation of maintenance costs.

Determine your investment needs, and budget accordingly.

7. Be a quick and accessible problem solver.

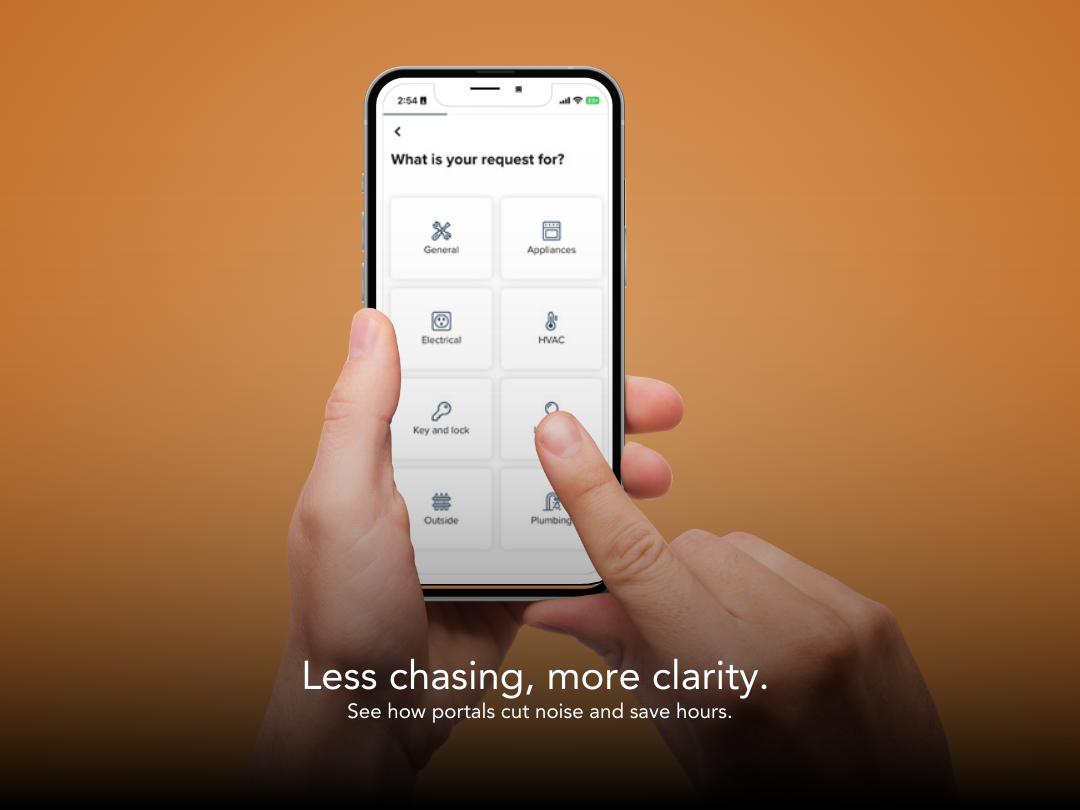

One of the key components of success in real estate investment is being able to respond quickly and accessibly to tenant and property problems. This is especially vital if you are managing the property yourself.

Balancing tenant needs with property protections demand that you are responsive and open to tenant concerns. This means fulfilling maintenance requests in a timely fashion, allowing tenants to communicate with you online or over text, and integrating technology to enable greater rental experiences.

A property management company with experience in using tech in investment success can help achieve the results you’re looking for while liberating your time. Hiring these experts may become an invaluable feature to work into your investment property budget, as property managers are proven to add value to the investment experience at various stages in the process.

Explore your options and keep these tips in mind as you enter the investment game. The right decision can lead you down the path to financial freedom and even early retirement, but you’ll want to consult expert help first. Investment decisions are best not made alone.

For more information on property management and real estate investment, contact 208.properties or find us on social media.